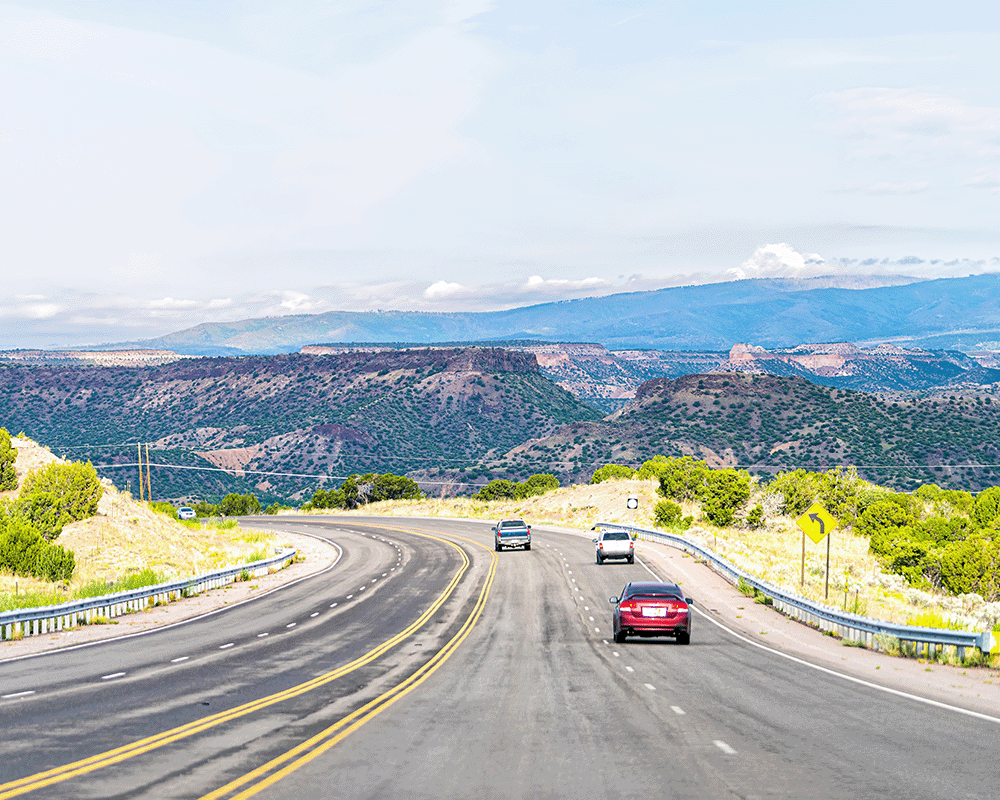

Your ride. Our low auto rates!

Car payment too high? You aren't stuck with a high-interest auto loan—refinance with Sandia Area and you could:

- Enjoy rates as low as 3.99% APR1

- Lower your monthly payments

- Pay your vehicle off faster

Plus, you'll enjoy 90 days with no payments!2

Benefits of Refinancing:

![]()

Competitive rates as low as 3.99% APR1 for 36 months

![]()

No payments for 90 days2

![]()

No refinance charges, No early payoff or prepayment penalties

| Term in Months | APR1 as low as |

|---|---|

| 1-36 | 3.99% |

| 37-48 | 4.29% |

| 49-66 | 4.79% |

| 67-75 | 5.29% |

| 76-84 | 5.59% |

Federally insured by the NCUA. An Equal Opportunity Lender. Membership eligibility required. Visit Sandia.org/Membership for complete details. 1. APR = Annual Percentage Rate effective as of 07/02/2025. Rates are subject to change at any time without notice. All loans, terms, and conditions are subject to credit approval. Not all applicants will qualify for the lowest rate. All consumer loans are charged simple interest with no pre-payment penalty. The actual interest rate charged is based on credit history, age of vehicle, and terms of the loan, which can only be determined upon receipt of the application. Terms up to 84 months available. Up to 125% financing. | |

2. Interest accrues during the 90-day deferral period.

See How Much You Can Save On Your Auto Loan!

Discover how refinancing your car loan with Sandia Area can free up cash for your next adventure.