The Grow Money Market savings account offers no minimum balance fees, full access to your savings, and an unmatched dividend rate for ANY balance over $500!

Big Earnings, Whether You Save a Little or a Lot

One great rate—whether your balance is $500 or $500,000. Anyone can save and grow with confidence.

Enjoy the benefits of a smarter savings account:

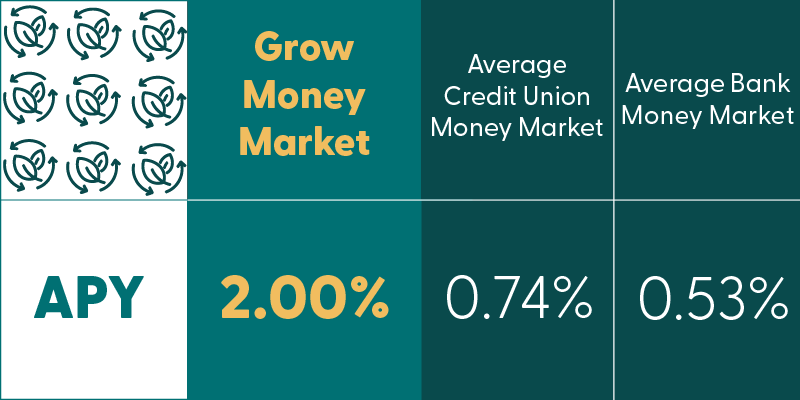

- High Earnings – One competitive rate for all balances, over 3X the national bank average.

- Secure – Your savings are federally insured by the NCUA up to $250,000.

- Accessible – Make unlimited deposits, in-person withdrawals, and up to six electronic transfers per month.

Risk-free growth with full access to your money—it’s savings that truly works for you.

CALL

Reach out to a Member Service Representative for assistance at 505.292.6343, or Toll Free at 800.228.4031

COME IN

Stop by a branch location for personal service.

Find a Branch